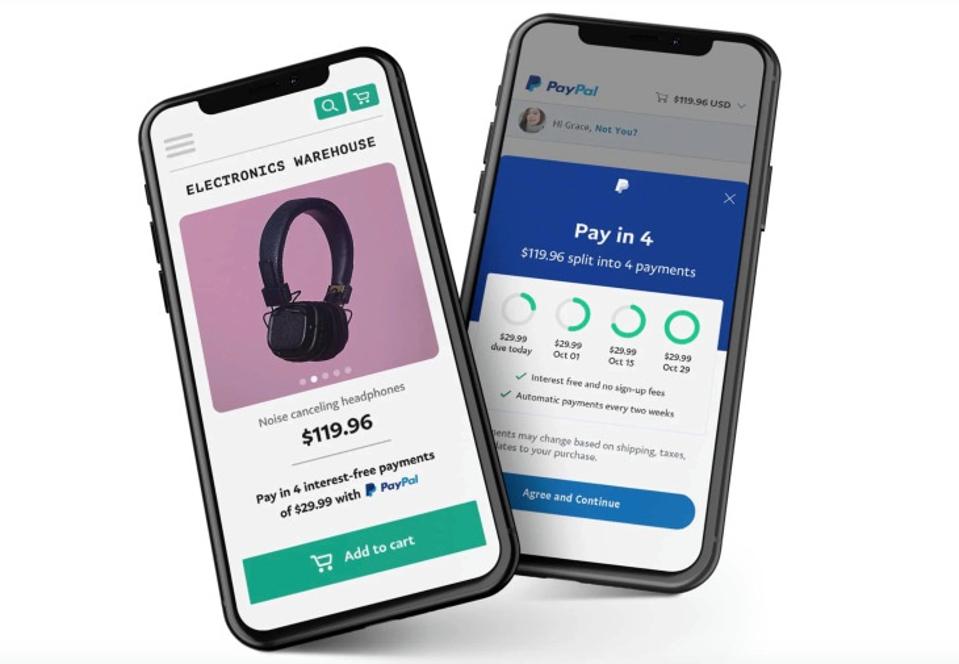

The launch of Pay in 4, PayPal's BNPL product, was added last year to compliment PayPal’s existing ... [+]

Pay in 4 was launched at the end of last year and continues to grow in popularity with shoppers. The short application process and simple to use format allows customers to pay for goods and services over four installments. It’s an option at checkout available to all PayPal

BNPL grows significantly in the U.S. market as more retailers offer this service to customers

The U.S. BNPL (buy-now-pay-later) market is expected to grow by 41.7% on an annual basis to reach over $126 million in 2021. Significant growth of the BNPL market in the U.S. can be attributed to a major shift to online purchasing, an uncertain economic slowdown in 2020 and consumers wanting more control over finances.

Pay in 4 is part of a growing group of companies specializing in the BNPL market including Affirm, Afterpay, Klarna and Sezzle. However, PayPal has actually been in the BNPL market longer since the acquisition of Bill Me Later back in 2008 which is considered a revolving credit product where users can pay back the amount borrowed within six months with no interest applied.

The launch and development of Pay in 4 was added last year to compliment PayPal’s existing products. Doug Bland, senior vice-president and general manager of global credit of PayPal, stated, “Pay in 4, which is part of PayPal's growing suite of Pay Later solutions, enables merchants and partners to get paid upfront while enabling customers to pay for purchases between $30 and $600 over a six-week period.”

In June PayPal will raise the upper limit on purchases from $600 to $1500, allowing shoppers additional flexibility when shopping for higher priced items and it has begun allowing consumers to repay directly from their bank account as opposed to credit or debit card.

Consumer data survey points to key reason why BNPL will continue to grow

Forrester

Doug Bland, senior vice-president and general manager global credit of PayPal, discussed why BNPL ... [+]

What younger consumers really want is full disclosure of the costs associated with any type of credit card or BNPL product. Bland said, “PayPal is a responsible lender and we are very transparent about lending money to consumers and what costs may be associated with that money including transaction fees, interest rates or other fees.”

Roughly 7 out of 10 younger consumers said they are likely to use a BNPL solution for furniture or for an item that costs more than $1,000, which prompted Pay in 4 to raise the upper limit on purchases to $1500.

Consumers trust companies that provide preferred payment methods

In another survey commissioned by PayPal with Netfluential, 71% of respondents were more likely to trust businesses that offer their preferred payment method and 28% of consumers ages 18-39 were more likely to shop at a merchant again if they offer a BNPL option. Key reasons for why today’s shoppers like the BNPL solution: 32% responded that they can make purchases they would otherwise postpone and 31% said they can afford what they need.

PayPal has really become a verb for the U.S. market (PayPal me) in terms of online transfer of money between users. The added advantage PayPal has in terms of customer loyalty is that it is the largest used method of online money transfer and is rated the most known and most liked by consumers. Additionally, PayPal has the highest user count in the U.S. market at close to 35 million in 2020; the next three companies range between 5.6 to 7.9 million users. The survey indicated 53% of young consumers (ages 18-39) trust PayPal to keep their financial information secure, as compared to an average of 3.7% among the top six competing BNPL providers.

PayPal’s first-quarter performance was the strongest in its history

In the first quarter of 2021, PayPal’s net payment volume amounted to about $285 billion U.S. dollars, representing a 50% increase compared to last year's Q1 results. This payment volume was generated through the approximately 3.74 billion transactions that PayPal processed during that period.

When asked about why BNPL has taken off in recent years, Bland stated, “With the shift to online shopping, consumers were using these methods as a safe type of budgeting tool. The uncertainty with finances including employment during the pandemic played a role, and interest free products really resonate with consumers across all demographics.” The ease of use is another major contributor to the growth of the market— BNPL apps make transacting online or in a store seamless.