BRAZIL - 2020/07/07: In this photo illustration the Xerox Corporation logo seen displayed on a ... [+]

[Updated: 5/26/2021] XRX Stock Update

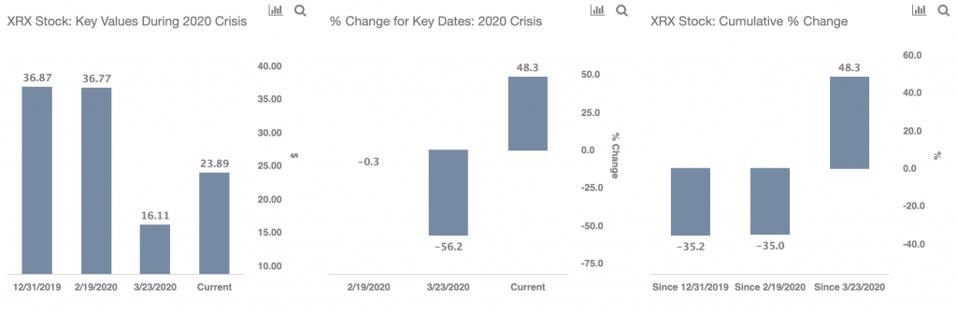

We believe that Xerox Holdings (NYSE: XRX), best known for its printers and copiers, is a good buying opportunity at the present time. XRX stock trades near $24 currently and it is, in fact, down 37% from its pre-Covid high of around $38 in March 2020 – before the coronavirus pandemic hit the world. XRX stock has seen a gradual rise from lows of $16 on March 23, 2020, when broader markets made the bottom, to levels of around $24 currently, reflecting a 48% growth.

This marks a significant underperformance compared to broader markets, with the S&P500 rising 88% over the same period. This can primarily be attributed to continued work from home policy for several offices, especially in Europe. However, now that roughly half of the U.S. population has received at least one dose of Covid-19 vaccine, the offices are expected to open up sooner than earlier anticipated. Although, the situation remains challenging in the international markets, which accounts for 40% of the company’s total sales, most of the countries are working on large scale vaccination programs, which should result in offices opening up over the coming quarters. This will aid the demand for Xerox printing products and page volume, boding well for XRX stock.

While XRX stock has underperformed in the current Covid-19 crisis, how did it fare in the 2008 crisis? In this note we focus on a comparative analysis of Xerox stock performance during the current financial crisis with that during the 2008 recession in our interactive dashboard.

Timeline of Coronavirus Crisis So Far:

- 12/12/2019: Coronavirus cases first reported in China

- 1/31/2020: WHO declares a global health emergency.

- 2/19/2020: Signs of effective containment in China and hopes of monetary easing by major central banks helps S&P 500 reach a record high.

- 3/23/2020: S&P 500 drops 34% from the peak level seen on Feb 19, 2020, as Covid-19 cases accelerate outside China. Doesn’t help that oil prices crash in mid-March amid Saudi-led price war

- Since 3/24/2020: S&P 500 recovers 88% from the lows seen on Mar 23, 2020, as the Fed’s multi-billion dollar stimulus package suppresses near-term survival anxiety and infuses liquidity into the system.

- 5/25/2021: Around half of the U.S. population has received at least one dose of Covid-19 vaccine, while 29% of the population is fully vaccinated.

Stock % Change

In contrast, here is how XRX stock and the broader market fared during the 2007-08 crisis

Timeline of 2007-08 Crisis

- 10/1/2007: Approximate pre-crisis peak in S&P 500 index

- 9/1/2008 – 10/1/2008: Accelerated market decline corresponding to Lehman bankruptcy filing (9/15/08)

- 3/1/2009: Approximate bottoming out of S&P 500 index

- 12/31/2009: Initial recovery to levels before accelerated decline (around 9/1/2008)

Xerox and S&P 500 Performance Over 2007-08 Financial Crisis

XRX stock declined from from levels of about $46 in October 2007 (pre-crisis peak) to levels of around $14 in March 2009 (as the markets bottomed out), implying XRX stock lost 70% of its value from its October 2007 levels. It saw a rebound to levels of around $22 by the end of 2009, reflecting a solid 63% growth from its bottom. In comparison, the S&P 500 Index saw a decline of 51% from its peak in September 2007 to its bottom in March 2009, followed by a sharp recovery of 48% by January 2010.

Xerox Fundamentals Have Been Lackluster Over The Recent Years

Xerox’s revenues decreased from $10.0 billion in 2017 to $7.0 billion in 2020. While the decline in 2020 can primarily be attributed to the impact of the Covid-19 pandemic, the decline prior to 2020 can be attributed to lower page volume. The company’s EPS has seen a slight growth to $0.85 in 2020, compared $0.71 in 2017. This can be attributed to an expansion of margins, led by reduced operating costs. Xerox’s EPS surged to $6.03 in 2019, primarily reflecting a gain from divestiture of 25% equity interest in Fuji Xerox and an indirect 51% partnership interest in Xerox International Partners.

Does Xerox Have Sufficient Cash Cushion To Meet Its Obligations?

Xerox has seen its total debt decline to $4.8 billion in 2020, compared to $5.5 billion in 2017, while its total cash increased to $2.6 billion from $1.3 billion over the same period. It also generated over $0.5 billion in cash from its operations in 2020. The company has a sufficient liquidity cushion to meet its near term obligations.

Conclusion

Phases of Covid-19 Crisis:

- Early- to mid-March 2020: Fear of the coronavirus outbreak spreading rapidly translates into reality, with the number of cases accelerating globally

- Late-March 2020 onward: Social distancing measures + lockdowns

- April 2020: Fed stimulus suppresses near-term survival anxiety

- May-June 2020: Recovery of demand, with gradual lifting of lockdowns – no panic anymore despite a steady increase in the number of cases

- Since late 2020: Weak quarterly results, but continued improvement in demand and progress with vaccine development buoy market sentiment. Multiple countries have undertaken large-scale vaccine programs for Covid-19, though new variants of coronavirus resulted in uptick in active cases.

As the global economy opens up and restrictions are lifted in phases, overall page volume as well as equipment sale for Xerox will rise, boding well for XRX stock in the near term. We believe that XRX stock can rally back to levels of over $35, implying around 45% upside from the current price.

[Updated: 1/26/2021] Xerox Stock Move

Xerox Holdings (NYSE: XRX), best known for its printers and copiers, has plunged by 11% over the last 10 trading days, after some of the brokerages downgraded the stock on the continued work from home policy for most offices, especially in Europe. More delay in returning to offices will directly impact the demand for Xerox printing products and page volume. In comparison, the broader S&P 500 grew 1.1% over the last 10 trading days. Now, is XRX stock poised to decline further? We don’t think so. We believe that the stock has seen a meaningful correction over the last year, and it still remains 45% below its pre-Covid highs of $38. Now with vaccines being approved in multiple countries, the offices will likely see a gradual pickup in footfall, boding well for XRX stock. There is a 51% chance of a rise in XRX stock over the next month (21 trading days) based on our machine learning analysis of trends in the stock price over the last 5 years. Note that XRX is also expected to report its Q4 2020 results on Tuesday, January 26, and the results will largely define the stock price move over the next few days. See our analysis on Xerox Stock Chances of Rise for more details. Curious about the possibility of rising over the next quarter? Check out the XRX Stock AI Dashboard: Chances Of Rise And Fall for a variety of scenarios on how XRX stock could move.

5D: XRX -8.6%, vs. S&P500 1.4%; Underperformed market

(5% likelihood event)

- Xerox stock declined 8.6% over a 5-day trading period ending 1/25/2021, compared to broader market (S&P500) rise of 1.4%

- A change of -8.6% or more over 5 trading days is a 5% likelihood event, which has occurred 58 times out of 1256 in the last 5 years

10D: XRX -11%, vs. S&P500 1.1%; Underperformed market

(20% likelihood event)

- Xerox stock declined 11% over the last 10 trading days (2 weeks), compared to broader market (S&P500) rise of 1.1%

- A change of -11% or more over 10 trading days is a 20% likelihood event, which has occurred 258 times out of 1240 in the last 5 years

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with over 100% return since 2016, versus 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams