getty

After stocks ended Tuesday well off their opening highs, stocks were set to start the day in the green yet again. Every day so far this week has started off positively. On this day, stocks have modestly risen, propelled by economic reopening plays. Carnival Corp rose about 1%, and Royal Caribbean

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

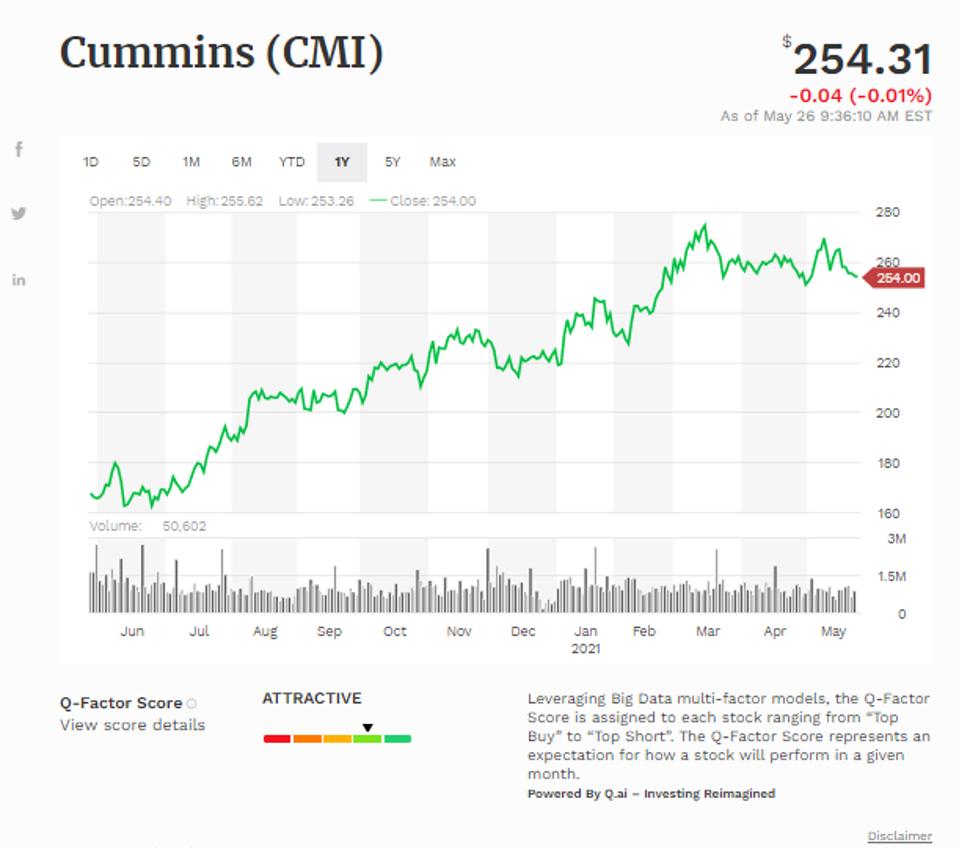

Cummins Inc (CMI)

Our first Top Buy of the day is Cummins Inc

Simple moving average of Cummins Inc (CMI)

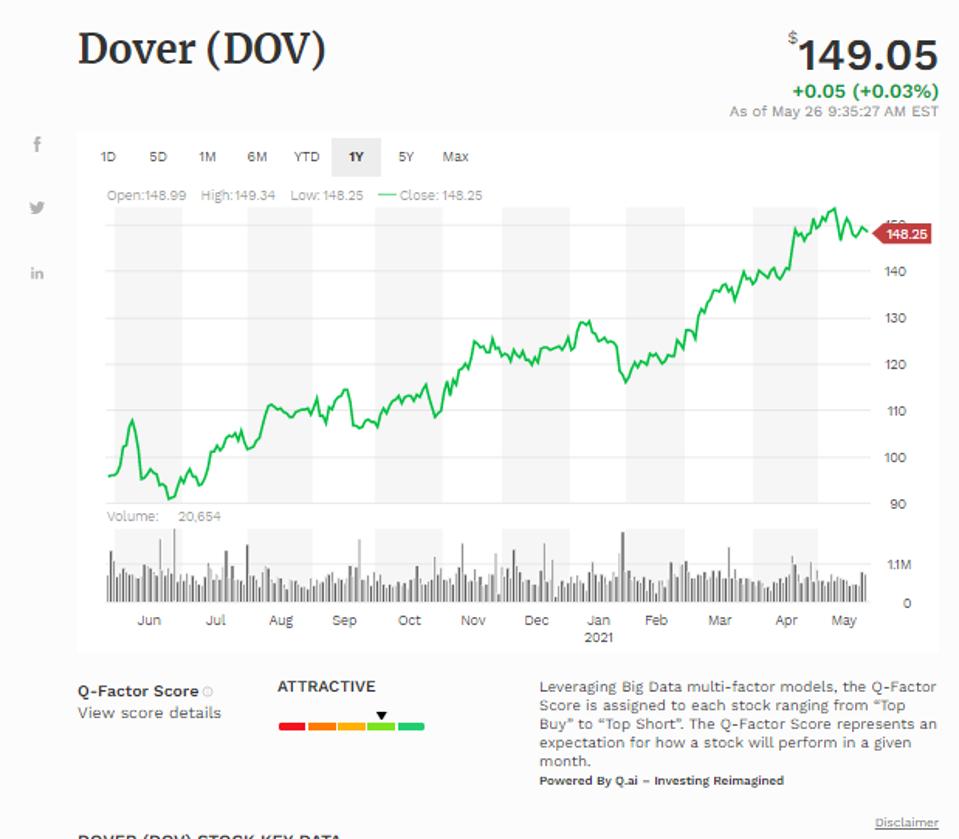

Dover Corp (DOV)

Our next Top Buy today is Dover Corp. Dover Corp is a manufacturing conglomerate focusing on industrial products. Our AI systems rated the company B in Technicals, B in Growth, A in Low Volatility Momentum, and B in Quality Value. The stock closed down 0.33% to $149.0 on volume of 797,611 vs its 10-day price average of $148.77 and its 22-day price average of $149.64, and is up 20.8% for the year. Revenue grew by 3.17% in the last fiscal year, Operating Income grew by 8.74% in the last fiscal year and grew by 18.66% over the last three fiscal years, and EPS grew by 8.49% in the last fiscal year and grew by 35.88% over the last three fiscal years. Revenue was $6683.76M in the last fiscal year compared to $6992.12M three years ago, Operating Income was $983.85M in the last fiscal year compared to $901.62M three years ago, EPS was $4.7 in the last fiscal year compared to $3.75 three years ago, and ROE was 21.3% in the last year compared to 16.53% three years ago. Forward 12M Revenue is expected to grow by 1.06% over the next 12 months, and the stock is trading with a Forward 12M P/E of 21.14.

Simple moving average of Dover Corp (DOV)

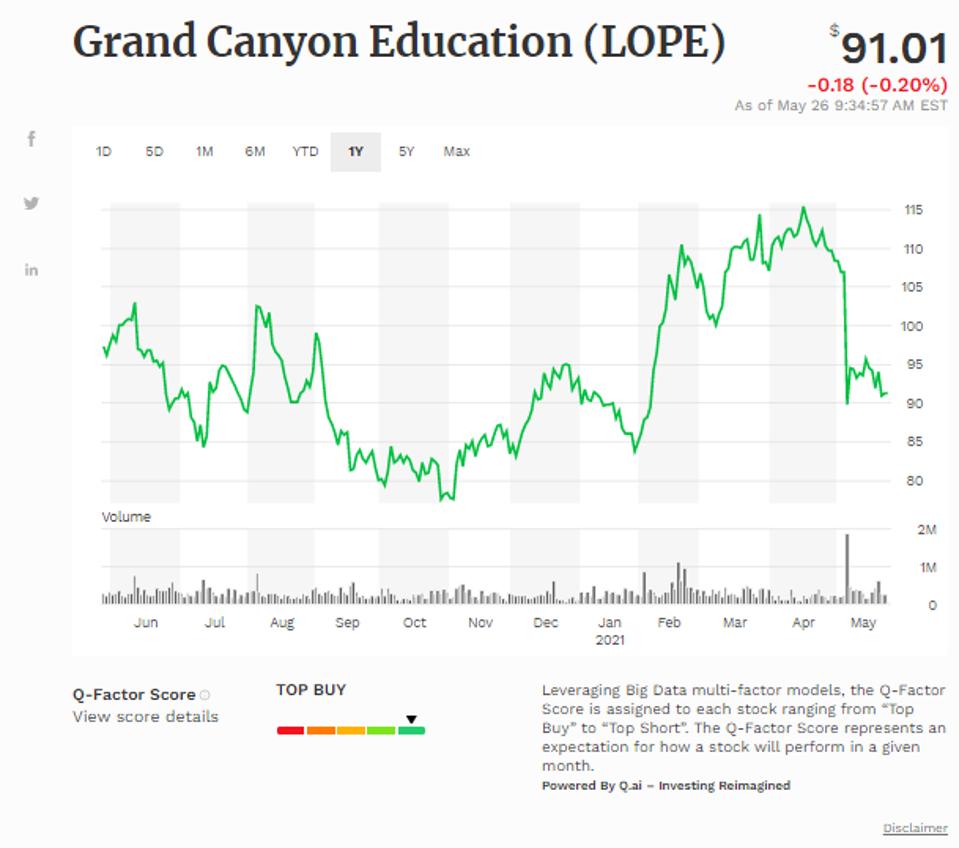

Grand Canyon Education Inc (LOPE)

Grand Canyon Education Inc is our next Top Buy. Grand Canyon Education is a shared services partner dedicated to serving colleges and universities across the country. Our AI systems rated the company B in Technicals, C in Growth, B in Low Volatility Momentum, and A in Quality Value. The stock closed up 0.24% to $91.19 on volume of 263,482 vs its 10-day price average of $93.29 and its 22-day price average of $98.95, and is up 1.65% for the year. Revenue grew by 1.81% in the last fiscal year and grew by 1.64% over the last three fiscal years, Operating Income grew by 1.24% in the last fiscal year and grew by 1.57% over the last three fiscal years, and EPS grew by 3.56% in the last fiscal year and grew by 19.32% over the last three fiscal years. Revenue was $844.1M in the last fiscal year compared to $845.5M three years ago, Operating Income was $277.44M in the last fiscal year compared to $276.52M three years ago, EPS was $5.45 in the last fiscal year compared to $4.73 three years ago, and ROE was 17.05% in the last year compared to 20.82% three years ago. Forward 12M Revenue is expected to grow by 1.72% over the next 12 months, and the stock is trading with a Forward 12M P/E of 14.37.

Simple moving average of Grand Canyon Education Inc (LOPE)

Starbucks Corp (SBUX)

Starbucks is our next Top Buy today. Starbucks, which is the largest coffeehouse chain in the world, operates over 30,000 locations worldwide in more than 70 countries as of early 2020. Our AI systems rated the company D in Technicals, B in Growth, B in Low Volatility Momentum, and B in Quality Value. The stock closed up 0.1% to $112.63 on volume of 5,391,837 vs its 10-day price average of $111.07 and its 22-day price average of $112.93, and is up 9.24% for the year. Revenue grew by 1.38% in the last fiscal year, Operating Income grew by 16.61% in the last fiscal year, and EPS grew by 7.47% in the last fiscal year. Revenue was $23518.0M in the last fiscal year compared to $24719.5M three years ago, Operating Income was $1599.9M in the last fiscal year compared to $3810.1M three years ago, EPS was $0.79 in the last fiscal year compared to $3.24 three years ago, and ROE was 136.23% three years ago. The stock is also trading with a Forward 12M P/E of 33.0.

Simple moving average of Starbucks Corp (SBUX)

Tyson Foods Inc -Cl A (TSN)

Tyson Foods, Inc

Simple moving average of Tyson Foods Inc -Cl A (TSN)

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.