getty

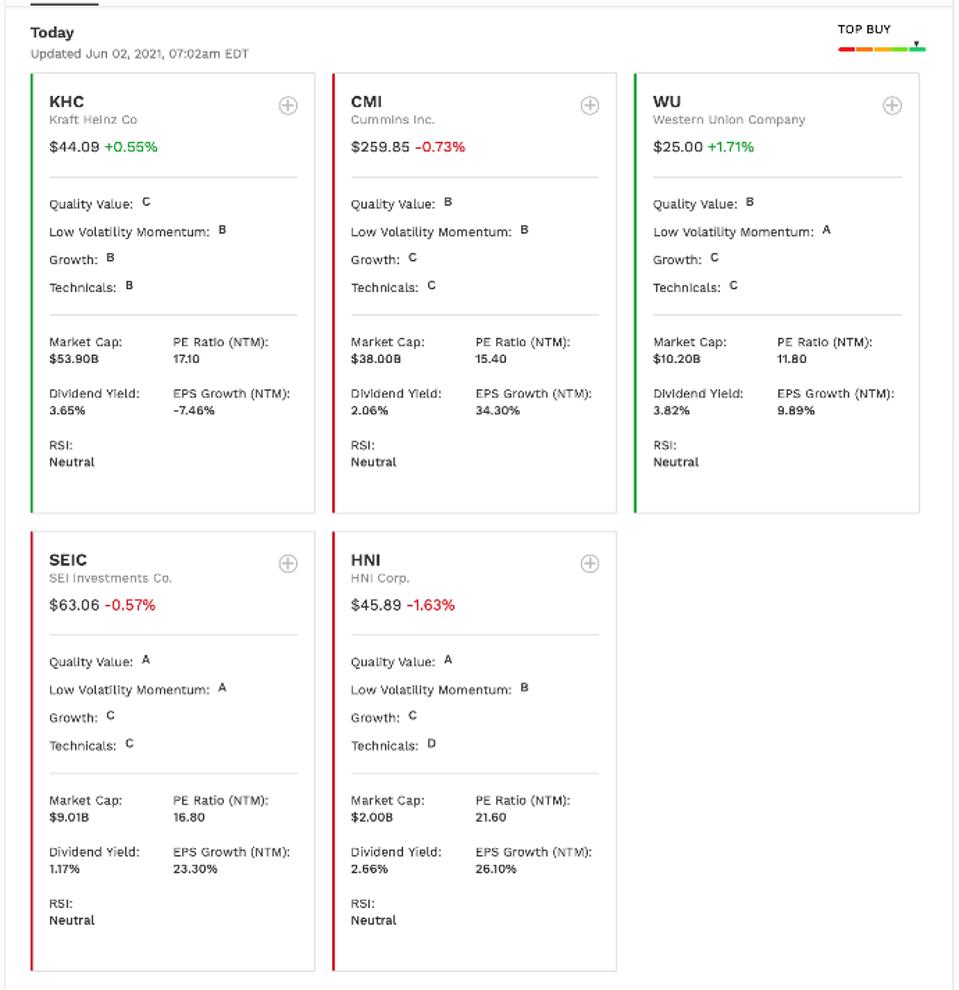

Every day, Q.ai brings you the stocks that trended throughout the previous trading periods, with up-to-date insights into why each stock turned up in investor’s portfolios (or, in some cases, back in the banks of the issuing companies). Today’s mix is a hodgepodge of what came out on top in the midweek, with companies in food production, consulting, and bizarrely, the only company that put a car on the moon driving to the forefront.

Let’s take a peek behind the curtain to see why these trending stocks… well, trended.

Forbes AI Investor

Q.ai runs daily factor models to get the most up-to-date reading on stocks and ETFs. Our deep-learning algorithms use Artificial Intelligence (AI) technology to provide an in-depth, intelligence-based look at a company – so you don’t have to do the digging yourself.

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

Tyson Foods, Inc (TSN)

Tyson Foods, Inc

Tyson is the world’s second-largest processor of chicken, pork, and beef, right after JBS. They’re trending this week due to a pair of unusual announcements. The first is that they’re expanding their plant-based product line into Asia Pacific – particularly Malaysia – under their First Pride brand using locally-sourced plant ingredients such as soy and wheat protein and bamboo fiber.

And secondly, the company announced Wednesday that CEO Dean Banks resigned after just eight months on the job, with 36-year company veteran Donnie King taking the reins immediately. King is Tyson’s fifth CEO in five years.

Tyson 5-year performance

Over the last year, Tyson’s revenue ticked up 0.13% to $43.2 billion, an 8% increase over $40 billion in revenue three years ago. At the same time, operating income expanded 8.5%, and 28.6% in the last three, from $3.15 billion to $3.73 billion, while per-share earnings nudged up 3% to $5.64 in the last fiscal year. However, return on equity fell from 25.4% to 14% in the same period.

Tyson Foods is expected to see 2.25% revenue growth over the next twelve months. However, our AI rates the meat processor barely above average, with a B in Low Volatility Momentum and C’s in Technicals, Growth, and Quality Value.

GATX Corporation (GATX)

GATX Corporation

GATX is one of the world’s leading equipment financing companies, primarily in the railcar space. In addition to railcar operating and locomotive leasing, they also hold investments in various industrial equipment.

GATX doesn’t come up in the news often because…well, there’s not really a lot to tell. As long as the company is doing its job well, the average American is unlikely to notice – and that’s just about GATX’s best-case scenario.

GATX 5-year performance

Over the last fiscal year, GATX saw revenue grow 0.5% to $1.2 billion, marking a 3.45% increase over the last three years. In the same periods, operating income rose 1.3% and 3.4%, respectively, from $279 million to $285 million. However, EPS fell from $5.52 to $4.27, while return on equity dropped from 10.6% to 7.9%.

Still, GATX has nowhere to go but up after an unprecedented year that saw consumer traffic dwindle drastically, and the company’s forward 12-month revenue is expected to grow by 3.2% over the next twelve months. Our AI rates GATX Corporation B in Low Volatility Momentum and C in Technicals, Growth, and Quality Value.

Gartner, Inc (IT)

Gartner, Inc

Gartner, Inc. is a global research and advisory firm that services just about every sector you can imagine. From IT and finance to legal and customer service, and a little bit of everything in between, they advise, inform, and provide tools to a wide variety of clients with a wide variety of needs. And as you can imagine, their services were more in-demand than ever during the pandemic – which saw their share prices shoot to all-time highs.

Gartner (IT) 5-year performance

Over the last three years, Gartner’s revenue has risen 5.3%, with the pandemic period bringing in 2% gains to the tune of $4.1 billion. Operating income grew 64.4% over the last three years and 21.4% in the last fiscal twelve months, which saw Gartner rake in over $495.7 million. Per-share earnings grew even faster, a total of 197.9% growth over the last three years from $1.33 to $2.96. And ROE nearly doubled from 13.4% to 26.3% in the same period.

Looking forward, Gartner is expected to bring in an additional 2% of revenue over the next twelve months. Our AI is overall keen on Gartner’s future, rating the advisory firm A in Growth and Low Volatility Momentum, B in Quality Value, and C in Technicals.

Costco Wholesale Corporation (COST)

Costco Wholesale Corporation

Costco is partly trending this week thanks to anticipation around its monthly same-store sales report for May due Thursday. Investor spirits are still riding high after its impressive Q3 2021 fiscal year report, which saw the warehouse chain’s sales leap 21.7% to $44.4 billion, with membership fee income up 10.6% to $901 million. However, EPS missed analyst consensus, which Costco attributed in part to lower gasoline sales and a $2 per hour wage premium.

Costco 5-year performance

Still, consumers spent more than ever at Costco warehouses throughout the pandemic, boosting the company’s last fiscal year revenue almost 12% to $166.76 billion. This marks a 32% increase over the $141.6 billion revenue three years ago. In the same periods, operating income grew 15.4% and 55.1%, respectively, from $4.5 billion to $6 billion in a 36-month span. All told, per-share earnings are up 50% in the last three years to $9.02 per share against $7.09 per share.

Currently, the company is expected to see 4.5% growth over the next 12 months, despite its massive earnings success in the pandemic. And our AI is equally positive on that matter – among others – with Costco rating A in Technicals and Low Volatility Momentum, B in Quality Value, and C in Growth.

General Motors Company (GM)

General Motors Company

GM’s trending status comes as the company jumpstarts plans to reopen several plans in June that choked out due to the chip shortage. Although the company hasn’t named too many specifics yet, management notes that its supply chain and manufacturing plants are working to mitigate the shortage while still providing consumers with the cars they crave in the post-pandemic punch-up.

On a slightly less serious – although arguably more intriguing – note, GM and Lockheed

And GM, the maker of the one and only Lunar Terrain Vehicle in existence (albeit fifty years ago, then a joint venture with Boeing

General Motors 5-year performance

Fun and battery-powered buggies aside, GM’s last fiscal year wasn’t its best revenue-wise, as cash flow dropped from $147 billion three years ago to $122 billion this year. However, operating income was up 27% in the last year to $8.6 billion, while per-share earnings leaped 43% to $4.33 – though this is down from $5.53 three years ago.

But with nowhere to go but up, and a potential NASA contract to bid on soon, GM is expected to see revenue growth of 6% in the next year. Currently, our AI rates General Motors C in Growth and Quality Value and D in Technicals and Low Volatility Momentum.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.