North Carolina Legislative Building, Raleigh. US.

As at the federal level, Republicans and Democrats in state capitals across the U.S. also want to take tax rates in opposite directions. This dynamic is currently on display in North Carolina, where members of the state senate unveiled a new tax relief plan on May 25. That proposal, introduced as an amendment to House Bill 334, would cut North Carolina’s flat state income tax rate from 5.25% to 4.99%. The corporate rate, which currently stands at 2.5%, would be phased out, making North Carolina the third state with no corporate income or gross receipts tax.

This tax relief package announced by North Carolina Senate Republicans, which also cuts the state franchise tax, stands in stark contrast to the tax plan recently proposed by North Carolina Democrats. In April, Democratic members of the North Carolina House of Representatives introduced HB 556, legislation that would move North Carolina from a flat income tax of 5.25% to a progressive income tax system with a top rate of 7%, resulting in a more than 33% increase in the state income tax rate for many households and small businesses.

As in Congress and in other state capitals, North Carolina Democrats market their proposed income tax hike as a way to target upper income taxpayers with higher rates. Yet, because the majority of small businesses file under the individual income tax system, HB 556 would also mean higher state income tax payments for tens of thousands of small businesses across North Carolina.

According to IRS data, more than 10,000 sole proprietors in North Carolina, along with more than 23,000 S-corp and partnership owners would be hit with the new top 7% state income tax rate proposed by Tar Heel State Democrats. Thousands more small businesses with income between $250,000 and $500,000 would be hit by the new 6.5% rate, which represents a more than 23% rate increase from the current 5.25% flat income tax rate currently paid by those employers. This is another example of how tax proposals advertised as ways to soak the rich often lead to a reduction in the job creating and sustaining capacity of small businesses.

While North Carolina Republicans have proposed phasing out the state corporate tax, Democrats have proposed doubling it. HB 556 would result in a 100% state corporate tax hike, taking the rate from 2.5% to 5%. While HB 556 was introduced by members of the North Carolina House of Representatives, Democrats in the North Carolina Senate have also backed this proposed tax hike.

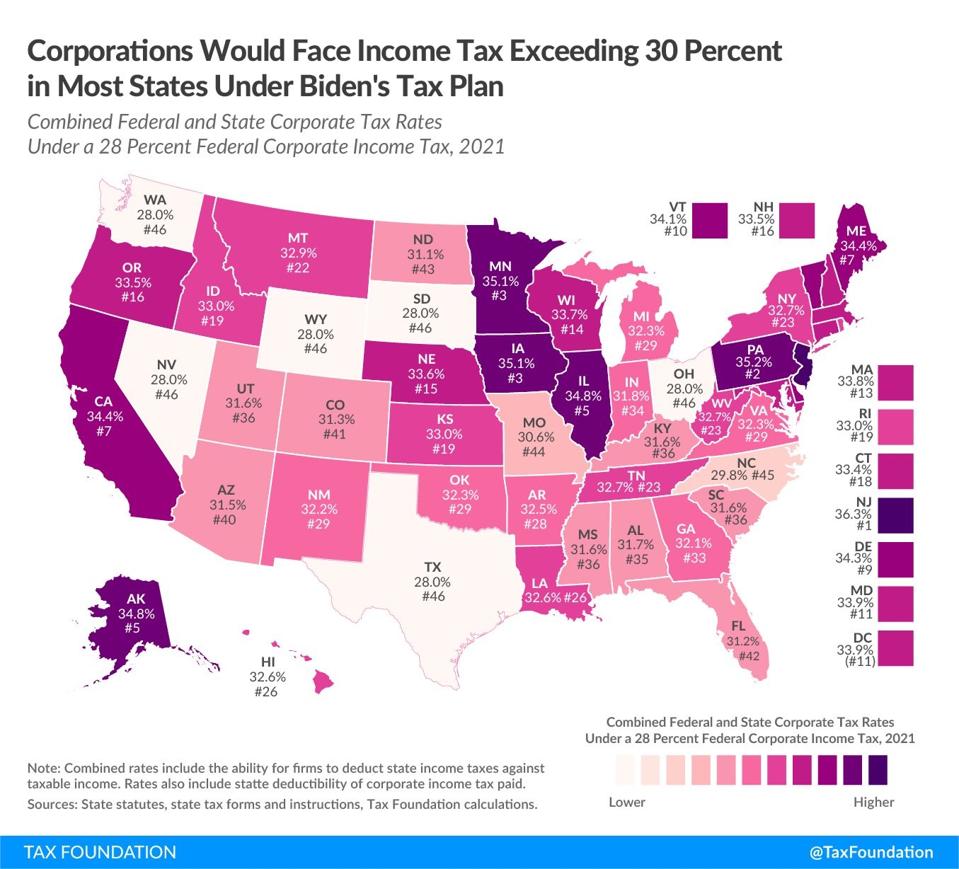

Thanks to reforms enacted by North Carolina Republicans after they took control of the General Assembly in 2010, North Carolina is now the only state in the southeast that would have a combined corporate income tax rate below 30% even when factoring in the federal corporate tax rate proposed by President Joe Biden.

Corporations would face income tax exceeding 30% in most states under Biden's plan.

The tax plan released by the North Carolina Senate yesterday would increase this advantage for North Carolina-based businesses. The tax hikes proposed by North Carolina Democrats, in contrast, would make the state corporate tax rate less globally competitive. The corporate tax increased proposed by Democrats in Washington and Raleigh would make it so North Carolina businesses face a combined 31.6% rate, putting them at a greater disadvantage relative to their competitors located in OECD member nations, who face an average corporate tax rate of 23.4%.

At the May 25 press conference announcing the new tax relief package, Senate Finance Committee Co-Chairman Paul Newton (R) explained that a decade of conservative budgeting and sound governance has put legislators in a position to provide further relief to individuals, families, and employers across North Carolina.

“We have large cash reserves and we have yet another budget surplus for the sixth and seventh years,” Senator Newton said at the May 25 press conference. “The Republican philosophy, when government takes too much money from the people, is to give it back in the form of tax relief. In our view, it's never, never the government's money, it's the people's money. So we are proposing yet another tax cut because we believe people spend their money better than government does.”

The non-partisan Tax Foundation ranks North Carolina’s state business tax climate as the nation’s 10th best. According to Jared Walczak, Tax Foundation’s Vice President of State Projects, North Carolina would have the nation’s fifth best state business tax climate if the tax plan recently unveiled by Senator Newton and his colleagues were to be fully implemented. Negotiations over the new tax plan put forward by Senate Republicans in Raleigh this week are expected to be wrapped into the broader budget debate, which will conclude later this summer.