UKRAINE - 2021/02/05: In this photo illustration a Robinhood logo of a U.S. financial service ... [+]

The line between Investing and trading certainly got blurred this year. As the long term rise of the retail investor converged with zero-fee trading, both Fidelity and Charles Schwab enjoyed a stellar year. But no one grabbed attention quite like Robinhood. With a friendly app and zero trading fees for stocks, options and cryptocurrencies, the company insists it aims to “democratize investing”. Investing shouldn’t be merely be easy or cheap, they say; the time has come for it to be fun.

Judging by the frenzied retail trading activity on the platform over lockdown – including the GameStop

Not quite. New evidence suggests patience-preaching wealth managers needn’t be worried their target audience will be shifting to Robinhood anytime soon. However, I’m also here to say: don’t get too complacent. For money managers, the 2021 trading boom reveals three crucial lessons.

Why Robinhood isn’t the future of wealth management

Trading’s been a recreational activity long before Robinhood burst onto the scene. But in 2021, between lockdown and social distancing, trading for fun definitely became an easier sell. With lockdowns coming to an end, evidence is showing the day-trading bonanza is quickly cooling off. Those who conflated gambling with investing are moving on to other interests.

But these were never wealth managers true prospects. What about the keen investor who truly believe frequent trading delivers long-term financial gains?

For this client segment, Robinhood will struggle to live up to its promise. Decades of research repeatedly affirm the same outcome: frequent trading leaves investors poorer. On Robinhood, trading activity is already much higher compared with other platforms. Over Q1 of 2020 its users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Schwab clients.

And now, new research shows that’s only half the problem. The Robinhood app displays far fewer stock tickers compared with other brokerage platforms. Instead, the app highlights stock lists, like the “Top Movers”, which features stocks with the largest daily price moves.

Mixing simplified information with user inexperience is a dangerous cocktail, the study showed. It leads to attention-driven buying and to buy-side herding events – usually followed by negative returns.

When it comes to real money, young investors like it boring

Trading is nothing like investing, but do retail investors know it? According to Vanguard, the answer is a resounding Yes. The asset-management giant tracked over five million of its retail household clients, from 2015 through to Q1 2020. Its recently-published How America Invests report reveals that, among the clients who trade, only a third are characterized as “frequent traders”.

Your trading enthusiasts are not the young crowd, either. The typical “individual security enthusiast” is in their mid-50s, nearly 20 years older than the typical “ETF enthusiast.”

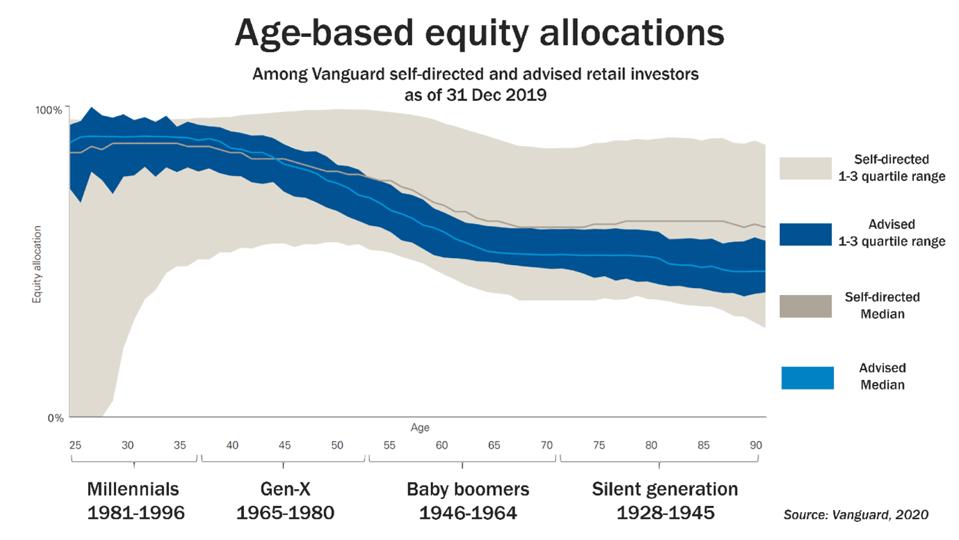

Not only are young investors more likely to invest in ETFs, they also tend to be more bearish on average (compared with their older peers), and hold much of their capital in money funds. It’s mostly the advised young cohorts who are allocating more of their holdings to high-return assets!

Age-based equity allocations

Wealth mangers: don’t let a good crisis go to waste

That advisors’ DNA is the polar opposite of Robinhood’s values isn’t a problem – it’s a business advantage. The 2021 day-trading rush may have eased, but the real lesson is just how well emotional messaging works. Here are three ways wealth managers can get smart with their marketing by showing just how much they’re unlike Robinhood:

1. Make it about someone.

Robinhood tells clients it’s breaking open sacred financial halls - previously reserved for the big guys – and letting everyone in. For wealth managers, the opposite of being for everyone is being for someone. For years I’ve been saying – pay attention to Millennials, they’re an important segment. Now, as the cohort is getting deeper into investing, becoming relevant for a particular niche is just as important.

Like I said in my previous Forbes column, it may not be about age at all. Instead, focus on behavior and life-stage events. Some Millennials don’t want to rely on tech when getting updates on their investments and instead prefer to hear directly from you. Similarly, you may have Baby Boomer clients who don’t want a call or an e-mail unless it’s an urgent situation and prefer to access a website or an app for routine news and account updates.

2. Make it about the emotion.

Last year, just as the pandemic was unravelling, I wrote for the FT:

“Wealth managers must not forget that emotional appeal is critically important in effective marketing, especially when the products and services themselves look pretty similar.”

In a year of loss, stress, anxiety, this has only become truer: the emotional opposite of gambling is security. Financial decisions are inevitably risky; but, while trading will you offer thrill and excitement, for major financial decisions clients want the exact emotional opposite. Clients want to fer to hear directly from you. Similarly, you may have Baby Boomer clients who don’t want a call or an e-mail unless it’s an urgent situation and prefer to access a website or an app for routine news and account updates.

2. Make it about the emotion.

Last year, just as the pandemic was unravelling, I wrote for the FT:

“Wealth managers must not forget that emotional appeal is critically important in effective marketing, especially when the products and services themselves look pretty similar.”

In a year of loss, stress, anxiety, this has only become truer: the emotional opposite of gambling is security. Financial decisions are inevitably risky; but, while trading will you offer thrill and excitement, for major financial decisions clients want the exact emotional opposite. Clients want to be assured they can achieve financial goals without having their life at the mercy of Elon Musk’s tweets. Marketers should seize the opportunity and appeal to emotions of comfort, safety and peace of mind.

3. Make about the goal.

When I recently moderated the Nucoro webinar, The rise of the digital retail investor, the panellists commented on how Savers, Investors and Traders are all different client types. But we agreed all money management eventually comes down to securing the client’s financial future.

Robinhood chooses to focus users’ attention on risky products and the very near-term future. But their emotional trigger is telling clients they can access privileges previously reserved for the few.

For wealth managers, that’s the takeaway. Have your marketing tap into the same potent emotional desire – but for the longer term. It could be having a wonderful holiday in year, or a gorgeous property in five. Beyond the pandemic, beyond lockdowns, clients in 2021 want to hear: it’s within your reach.