Photographer: Peter Boer/Bloomberg

The period of May-June EOM strength began on May 31 and runs to June 12. This period has been up 64.4% of the time. The first part of June will likely be the strongest and the second half is likely to be the weakest. Expect an S&P top near the 18th.

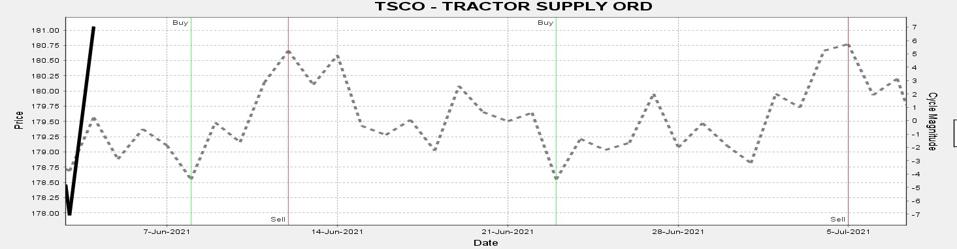

The Tractor Supply

Chart 1: Tractor Supply Daily Cycle

The daily cycle points to a price rise in this week.

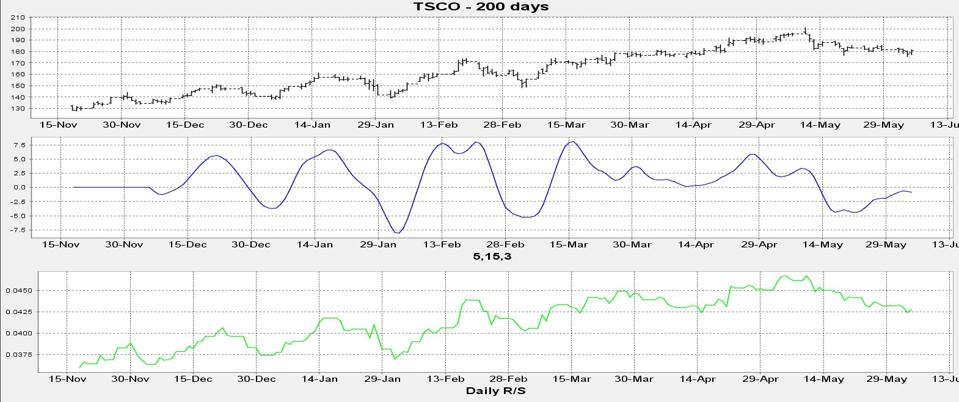

Chart 2: Tractor Supply Daily Graph

The stock is poised to stage an oversold rally.

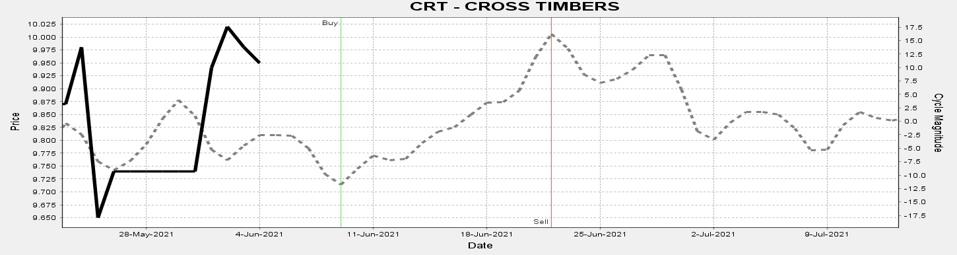

Here is a buy in the strong energy sector. Cross Timbers Royalty Trust operates as an express trust in the holding 90% net profit interests in certain producing and non producing royalty properties in Texas, Oklahoma, and New Mexico. The Trust was founded in 1991 and is based in Dallas. The Cross Timbers weekly cycle hits a low on the 5th, and tops on the 22nd. All seven buy signals have made money in the last year. The monthly cycle is on a buy signal into July 5. All four monthly buys in the last year have been successful.

Chart 3: Cross Timbers Weekly Cycle

The CRT cycles are rising within the strong energy sector.

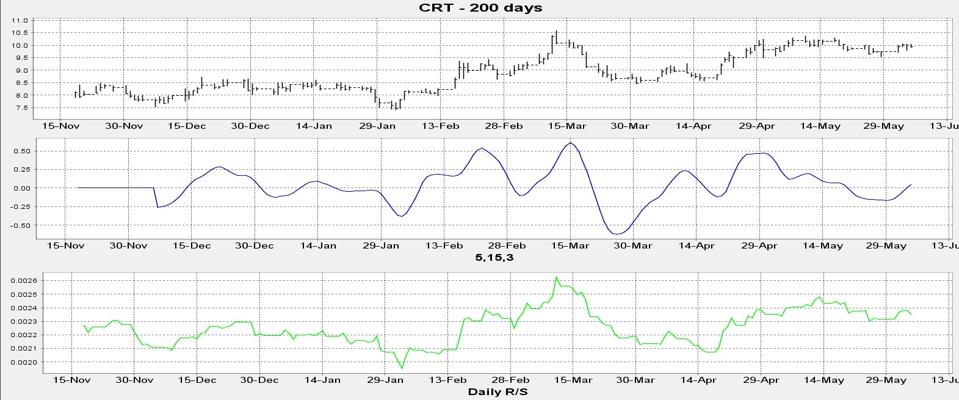

Chart 4: Cross Timbers Daily Graph

The stock is oversold and the momentum oscillator is turning up.