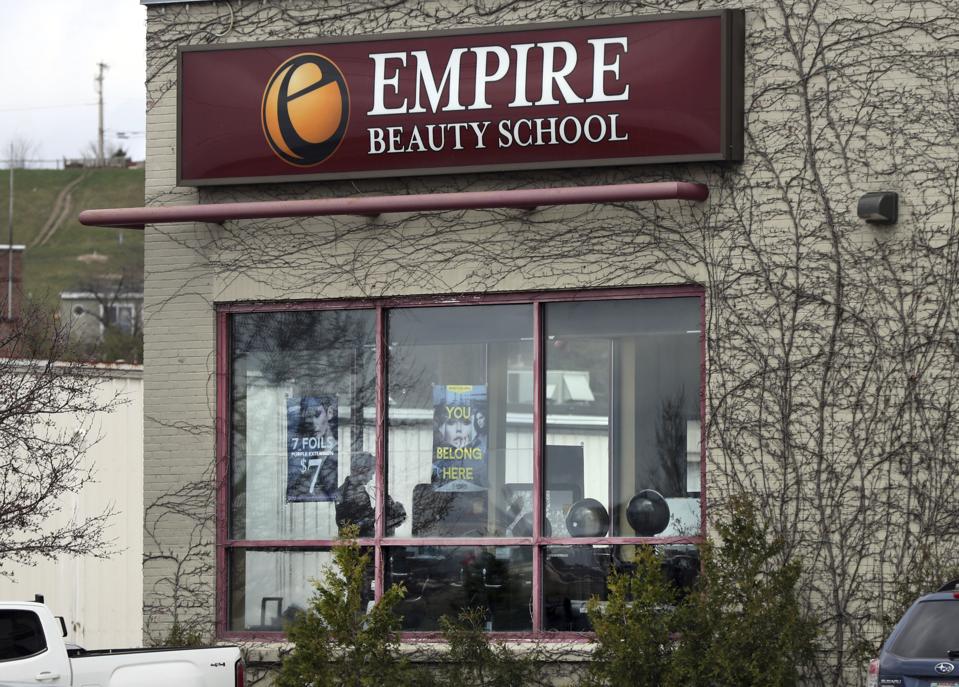

The Empire Beauty School, a for-profit college, is seen Wednesday, April 19, 2017, in Portland, ... [+]

As a student, or maybe the family of a college student, measuring a school based on the return on financial investment - the anticipated salary boost of the degree minus the cost of getting it - is dicey.

Not only are the answers wildly varied based on factors such as the major, the reputation of the school and the actual cost, but other things such as the student experience, geography, legacy or unique programs may be more important than simply tallying dollars in, dollars out.

For others, and for policy leaders in particular, knowing the return on investment is quite important. That’s because legislators and department leaders set the rules about what institutions are eligible to receive public funds in the form of grants or government student loans.

Likewise, students from less affluent circumstances may do well to zero in on the potential financial rewards of their college choices - especially if their primary purpose for going to school is to make more money. Presumably, less wealthy students and families can least afford the risk, the loss of making any bad investment.

Where those two groups overlap - where government funds are flowing to schools that are letting down poor students in terms of financial outcomes - everyone should be aware and troubled. Unfortunately, that is happening all too often. And so far, policy makers have been unwilling to do much about it - turning a blind eye to the schools that are sucking up funds from the public and poor students simultaneously while returning next to nothing.

A new report from Michael Itzkowitz, Senior Fellow, Higher Education at policy think thank Third Way, highlights the ongoing, exploitive, wasteful situation.

Setting the stage, about a year ago, Itzkowitz and Third Way delivered another report on return on educational investment. That report showed that most colleges return enough in salary boosts to quickly pay off whatever the true cost was, though the results were very uneven. For example, more than half (51%) of for-profit schools will never deliver enough financial benefit to recover the costs of attending. In other words, at more than half of all for-profit, proprietary schools, a student will actually lose money by going there.

That’s overall. This new report out this April looks more specifically at low-income students - the students who not only receive more public aid but more often depend on the financial returns promised by a college education. The new report shows that, for those students, the return results are even more alarming.

For students whose families earn $30,000 a year or less, the return on actual costs is quite good at public schools - 68% of public schools provide enough return to allow students to recover their investment in just five years or less. Go out ten years and nearly 80% of public schools pay off the investment entirely.

At the private, non-profit schools, the results for poor students are good too. The report shows that 78% of them return the money in a decade or less.

But at the for-profit schools, the story is different. According to the report, just one in four for-profit schools are good enough to return what students pay with ten years. But at 69% of those schools, the breakeven point on initial investment is 25 years or more away. A shocking 63% of them deliver no net financial education benefit to poor students at all - ever.

Most for-profit colleges are funded by private investors seeking to pocket the difference between what the college can charge in tuition and collect in loans and what they spend on actual education. For them, the more they can charge and collect and the less they can spend, the more profit. It’s pretty easy math.

But probably very few of those investors would make an investment in which there was a 63% chance they’d lose money. Or an investment in which there there’s a nearly 70% that they won’t break even for at least 25 years, if ever. Yet, that’s exactly the wager they’re asking poor students to make. The wager they’re expecting taxpayer to continue to make.

With the lack of returns so obvious, so obnoxious, it’s inexplicable that policy leaders allow the pattern of taxpayers paying investors to fail the exact students in the most need. And yet they do.

In a post on Medium, Itzkowitz says that the federal government spends about $1.9 billion on aid and grants to schools at which the majority of its students earn less than an average high school graduate in their state.

It’s a perfectly reasonable and modest standard to expect that we stop spending billions of dollars on schools where half the students can’t top the income of those who didn’t finish college. And yet we keep paying them, paying off their investors, watching them fail to deliver over and over again.