A few months ago, one of Uber’s lawsuits against mobile advertising fraud came to conclusion — they won, and the mobile advertising company Phunware settled and paid the multimillion-dollar fine. Phunware ($PHUN) remains publicly listed on NASDAQ.

According to details published by Uber’s law firm, “evidence of widespread and continuing fraud came to light, [and] egregious destruction of evidence. Much of the ad traffic Phunware brought for Uber also came through auto-redirects, which automatically took visitors to an app store, whether the user clicked on the ad or not. Phunware had falsely billed Uber for ad clicks they did not deliver. A widescale culture of fraud continued for many months. For example, in an email sent on Oct. 31, 2016, a Phunware employee wrote: ‘Guys it’s… time to spin some more BS to Uber to keep the lights on.’ Phunware attempted to cover this up as well by falsifying reports, which made it appear as if the ads were placed on legitimate, non-pornographic sites instead.”

The case is Phunware Inc., vs. Uber Technologies Inc. and Uber Technologies Inc. vs. Phunware Inc., case number CGC-17-561546, in the Superior Court of the State of California, County of San Francisco.

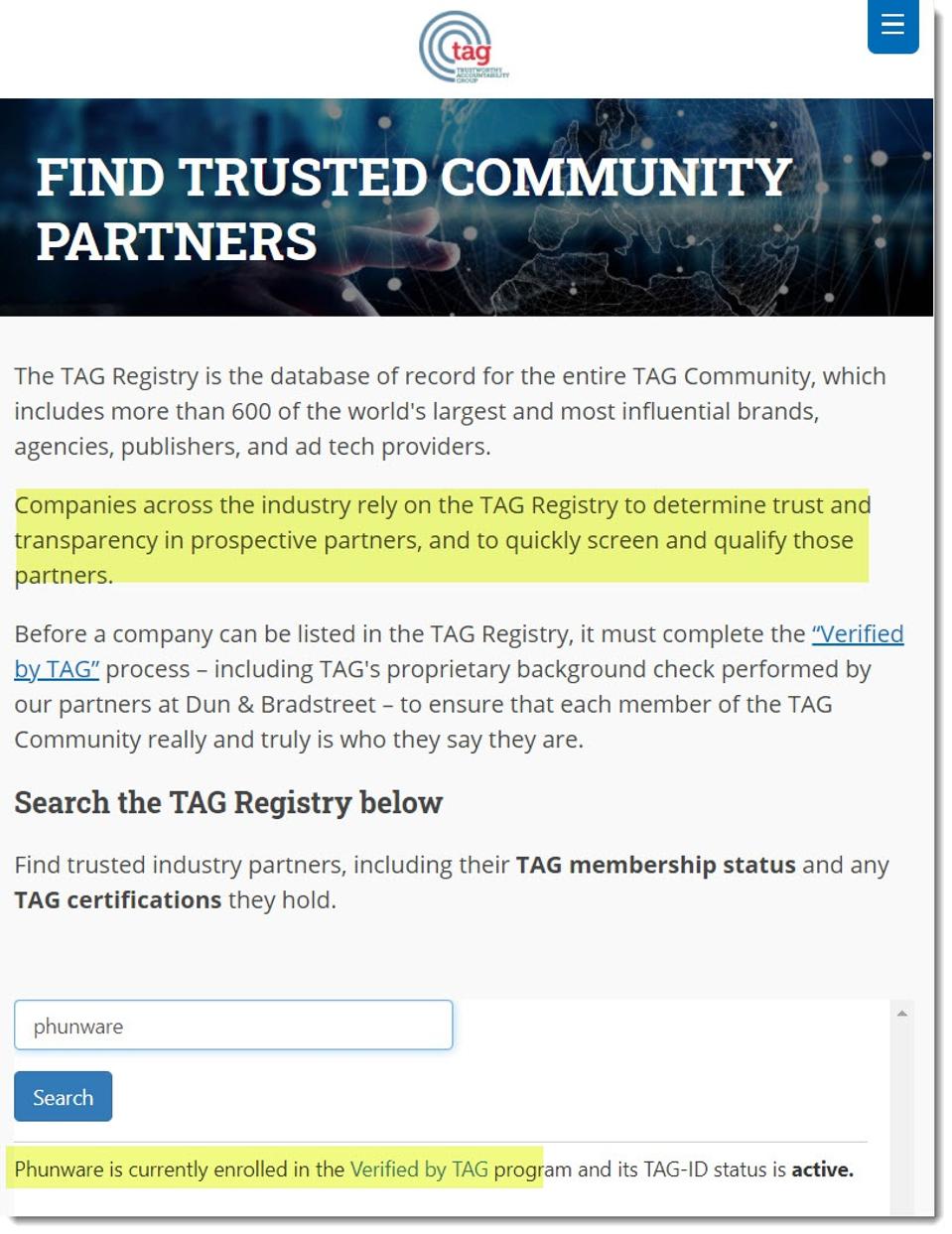

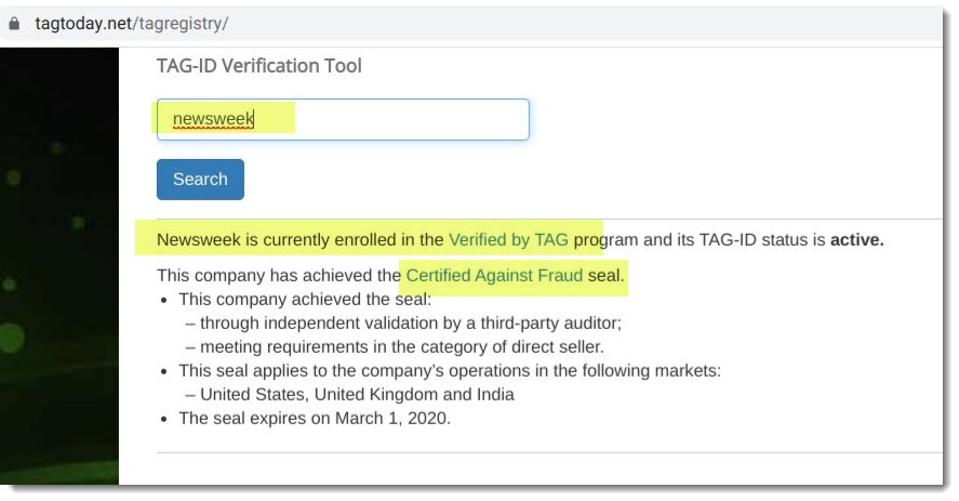

“TAG Certification” Fails to Protect Anyone From Ad Fraud

Trustworthy Accountability Group (TAG), an industry body created by the ANA, IAB, and 4As, gives out “certified against fraud” seals after receiving self-attested paperwork and fees from companies. TAG currently lists Phunware as “Verified by TAG.” TAG claims on their site that “companies across the industry rely on the TAG Registry to determine trust and transparency in prospective partners, and to quickly screen and qualify those partners.” Clearly, TAG’s “certifications against fraud” fail to stop fraud, including the egregious and obvious example above, and now the convicted fraud below. TAG also listed Newsweek as “certified against fraud” when Newsweek was caught using malicious code to alter viewability measurements fraudulently.

TAG registry shows Phunware as "verified"

Newsweek certified against fraud

“King of Fraud” Found Guilty

Today brings news of the guilty verdict for the self-proclaimed “King of Fraud.” He was found guilty of using “a bot farm and rented servers to fake internet traffic at media sites, leading companies to pay inflated advertising rates. Companies such as PepsiCo, charities and other advertisers were charged inflated rates only for digital robots to “watch” their ads. The scheme [used] 1,900 servers in Dallas and Amsterdam to circumvent fraud protections and simulate the online activity of millions of people viewing online advertisements. But [the defendant] claimed he never misled anyone and figured he was only giving the industry what it wanted — a way to cheaply, if artificially, boost site traffic. ‘There was nothing to conceal,’ he testified. ‘Why to lie to them if we have bot traffic? Why to lie, try to sell it as human if it’s bot? We were making business. We are not making scam or fraud.’”

Russian ‘King of Fraud’ Aleksandr Zhukov Is Found Guilty of Online Ad Scam - Bloomberg

The case is U.S. v. Zhukov, 18-cr-633, U.S. District Court, Eastern District of New York (Brooklyn).

Interestingly, the above defense “why lie? We were just giving the industry what it wanted — cheap traffic” didn’t work in 2021, but it was working splendidly in 2015. According to a report in Bloomberg, Boris, from Brooklyn, “built a minipublishing empire, Boris Media Group, largely through the acquisition of cheap—and, often, fake—traffic. He freely admits he buys many of the visitors to his websites, cheap traffic whose origins he isn’t as sure about. [Two fraud detection firms] separately found that 94% and 74%, respectively, of [his traffic was] bots. Boris didn’t dispute the findings or appear at all concerned. “If I can buy some traffic and it gets accepted, why not?” he says. And if advertisers don’t like it, he adds, “they should go buy somewhere else. They want to pay only a little and get a lot of traffic and results. If they want all human traffic, they should go direct to the publisher and pay more.”

What is clear in the two recent examples is that more fraud is being caught when advertisers look more closely at their own analytics and ask for more detailed data around their digital media buying, especially in programmatic channels. Some lawsuits against fraud are coming to fruition and establishing “case law,” since there are no existing laws against ad fraud. But there are laws against computer crimes, wire fraud, mail fraud, common law fraud, money laundering, and “engaging in monetary transactions involving property derived from unlawful activity,” and securities fraud (i.e. public companies artificially inflating revenues by fraudulent means).

So What?

Marketers, it’s time for you to look more closely at your digital media, with analytics that shows you why something is fraudulent and enables you to troubleshoot the problems while the campaign is still running. Don’t rely on certifications that don’t work; that’s an embarrassing waste of money. There are many advertisers now using analytics to monitor their own campaigns; they find and remove the fraudulent sites and apps that are committing ad fraud, no TAG certifications needed. Read on for some real life examples in the article below.

bot vs human